Q3 2019: Outlook reaffirmed

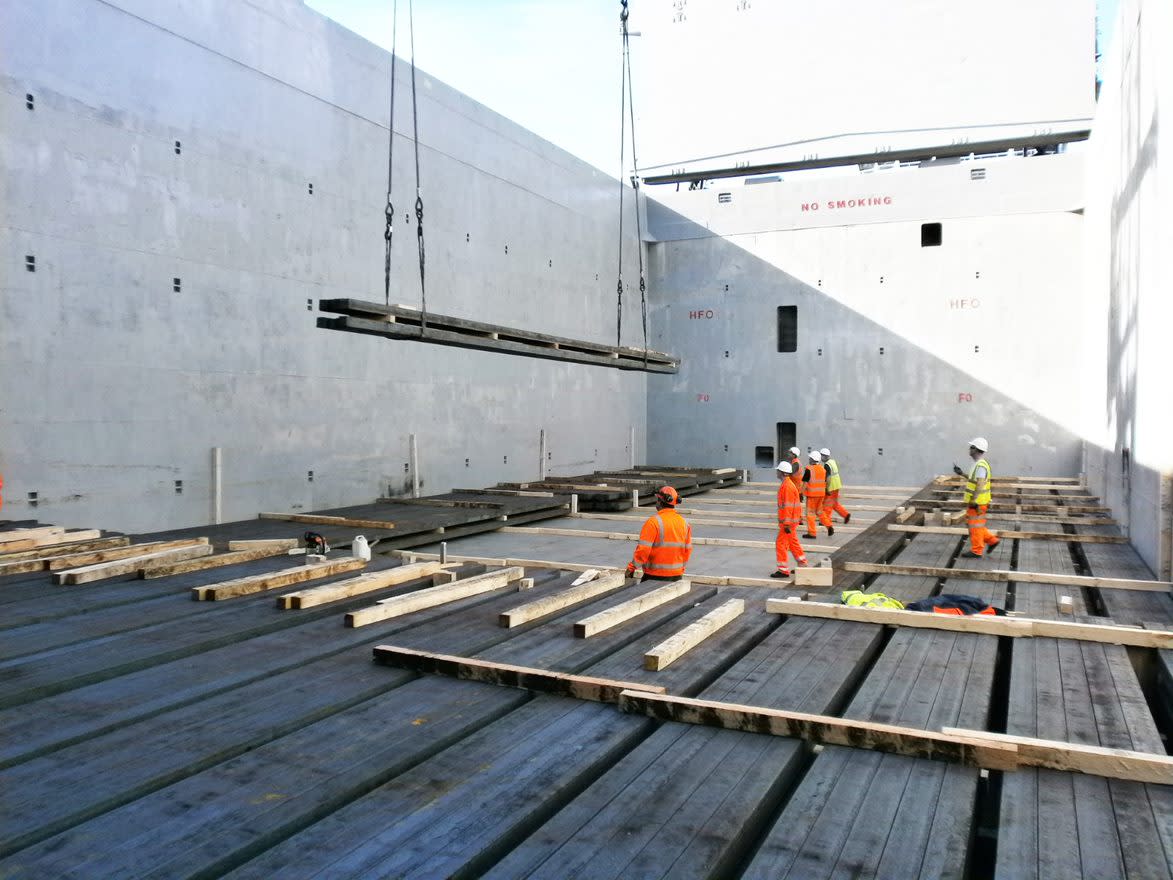

DFDS’ ferry routes are part of Europe’s infrastructure, providing vital services for trade and travel. We are exposed to market developments in the regions we serve but the business model is resilient, and earnings remain robust despite the current headwind for trade.

Revenue up 2% to DKK 4.5bn

EBITDA on level at DKK 1.2bn

Profit before tax up 4% to DKK 647m

EBITDA outlook range narrowed

DFDS Outlook 2019

Due to the ongoing European slowdown, expected revenue growth is now around 6% (previously: 6-8%).

To reflect a reduced risk of a no-deal Brexit occurring in 2019, the outlook range for EBITDA before special items is narrowed to DKK 3.55-3.75bn (previously: DKK 3.5-3.8bn), (2018 restated to IFRS 16: DKK 3,589m).

DFDS continues Brexit preparations

DFDS’ main Brexit focus is now on informing small and medium sized companies about how they can and need to prepare for Brexit.

Anne-Christine Ahrenkiel to be DFDS’ new Chief People Officer

Anne-Christine Ahrenkiel will join DFDS’ Executive Management team as the new EVP Chief People Officer.

The DFDS share

See the latest share price development and access relevant information for shareholders.