2021 border checklist for importers and exporters

Export procedures

Now that the UK is no longer part of the EU, you need to follow these steps to prepare exports:

What you need to do:

1) Register for an Economic Operator Registration and Identification number (EORI) in your country’s customs website.

2) Check if you need a license to export your goods

A comprehensive list of prohibited and restricted goods can be found in your country’s customs authorities’ website.

3) Establish the origin of the goods

Establishing the origin of the goods will help to identify whether they qualify for lower or no customs duty under a tariff preference scheme.

For goods produced of materials from more than one country, there are several criteria to follow.

4) Find the commodity (HS classification) code of your goods

You will find guides for this in your country’s customs authority’s website, which will also (in most cases) be able to inform you about possible duties.

5) For each consignment, you must complete a commercial invoice

The commercial invoice should contain the sales price of your goods in order to complete the customs documents.

What we can help you do:

You also need to do the following for each consignment. DFDS has developed a service to assist you with those so you don’t have to worry about these. Please contact your local DFDS contact.

6) Declaring your export to customs

The normal procedure is to use a customs broker or agent for this. Please contact your local DFDS office if you want us to assist you with this. An export declarations per consignment must be pre-lodged with customs. The documentation for this has a Movement Reference Number (MRN) which the driver must have in order to be able to enter the port of departure.

7) Relevant documents must be provided for your consignment

The relevant documents may be

- Commercial invoice

- Certificates of origin

- Licenses and certificates (such as for food and plants)

- The Export or Transit Accompanying Document (EAD) issued by customs

- Export: Combined customs and safety and security declaration

8) The goods must be presented to customs

Notification of the arrival of goods at the required location for customs control is referred to as presentation of the goods to customs. Customs will examine the ‘arrival message’ and determine whether the goods have permission-to-progress or need examination etc.

9) Finalise the export entry on the national customs system

Once the means of transport upon which the goods were loaded has physically left the exporting territory, a departure message must be submitted to customs by the ferry operator.

Import Procedures

Now that the UK is no longer part of the EU, you need to follow these steps to prepare imports:

1) Register for an Economic Operator Registration and Identification number (EORI) in your country’s customs website.

2) Find out the commodity (HS classification) code to classify your goods for the import declaration.

Classifying codes can be found in your country’s customs authorities’ website. The codes will tell the amount of duty you pay and whether you need an import or export license for the goods.

3) Establish the origin of the goods

Establishing the origin of the goods will help to identify whether they qualify for lower or no customs duty under a tariff preference scheme.

For goods produced of materials from more than one country, there are several criteria to follow.

See more here or here.

4) Check for import restrictions or additional requirements

In your local customs website there will be a guide on import restrictions, need for additional requirements or import licenses.

5) For each consignment, determine the value of your goods

The value of the goods is necessary to determine the customs duty applicable.

You arrive at the value of the goods by using one of six ways or ‘methods’. See more here.

You also need to do the following for each consignment.

6) Declare your import to customs

The normal procedure is to use a customs broker or agent for this. Please contact your local DFDS office if you want us to assist you with this.

7) Duty and VAT

Possible import duty and VAT depend on the classification of the goods and where they come from. Information on this can be found in your country’s customs website.

For UK imports

Three phases for UK importers

If you are a UK importer, the transition is likely to take pace in three phases. Instead of full checks from January 1, 2021, a staged approach to customs declarations and checks will be introduced at the UK's main entry points for imports from the EU.

Stage 1 – January 1, 2021

Standard Goods

As a trader, you can record the movement by making an entry in your own records.

You have six months after the movement to make supplementary declarations.

Duty and VAT is to be paid upon arrival or delayed using an authorised duty deferment account and postponed VAT accounting.

There is no requirement for safety and security declarations at this point. We need the importer’s EORI number in order to release cargo for delayed clearance.

Controlled Goods

Full customs formalities are required for Controlled Goods with the exception of safety and security declarations which will not be required until 1 July 2021.

Sanitary and Phytosanitary Goods

A pre-notification must be made to HMG if moving Live Animals or High Risk Plants and Plant Products. Duty and VAT is to be paid upon arrival or delayed using an authorised duty deferment account and postponed VAT accounting.

There is no requirement for safety and security declarations at this point, nor is there a requirement to move through a Border Control Point.

Where applicable Export Health Certificates is required.

Stage 2 – April 1, 2021

For Standard and Controlled Goods, the same rules apply in the first and second phases, please see above.

Sanitary and Phytosanitary Goods

A pre-notification must be made to HMG if moving Products of Animal Origin, Live Animals, High Risk Food and Feed Not of Animal Origin and all Regulated Plants and Plant Products.

Duty and VAT to be paid upon arrival or delayed using an authorised duty deferment account and postponed VAT accounting.

There is no requirement for safety and security declarations at this point, nor is there a requirement to move through a Border Control Point.

Where applicable Export Health Certificates will be required

Stage 3 – July 1, 2021, and beyond

Full border and customs formalities are required from 1st of July including safety and security declarations.

If required, goods must enter the UK through a port with a Border Control Point. Please note that cargo being moved under the Common Transit Convention (CTC) will need to complete Office of Transit formalities from January 1, 2021.

Step by step guides:

Download links to detailed description of process flows:

- Information on importing

- Information on exporting

- Information on moving meat, diary and plant products

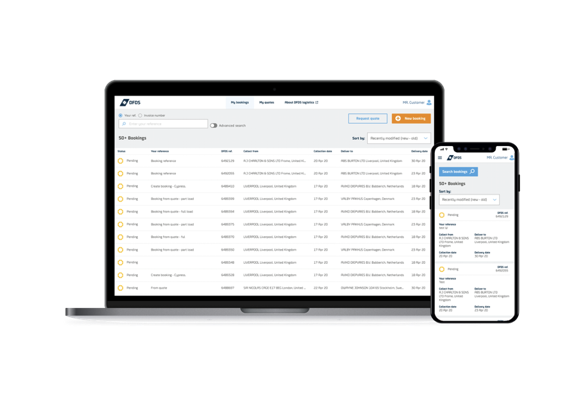

Quote, book and track online with DFDS Direct

Our logistics platform enables you to book international transports in and out of UK, as well as upload and download relevant transport documents like CMR and customs clearance documents.

Are you a freight ferry customer?

Access the Brexit checklists for the DFDS freight ferry customers on:

Q&A: Your top Brexit questions answered

What changed when the UK left the EU on December 31, 2020? What's done to avoid congestion and slow check-in at ports? Do unaccompanied trailers require a Security & Safety declaration?

Read the detailed answers to all your questions on how to best prepare your business for UK border control.

Leave customs to us

As an EU certified AEO customs operator in many European countries you don’t have to be a customs specialist yourself – leave it to us. Simply get in touch with us and we’ll handle your customs declarations in your own language and in due time.